This week is a big week for my snowball! I just knocked out another credit card! YAYY! And I had some left over to throw at my LAST CREDIT CARD! Yes, you read that right. SO EXCITING!

Continue reading “Debt Update!!”Tag: fire community

Is the FIRE movement “Judgy”

I have seen much controversy in the news and even in my financial groups on social media surround the FIRE movement. There is everything from Naysayers to people outright saying the FIRE community only fits a certain narrative, is judgmental and even sexism and racism have been brought into it. So, is it all true?

Continue reading “Is the FIRE movement “Judgy””Paid off another credit card!

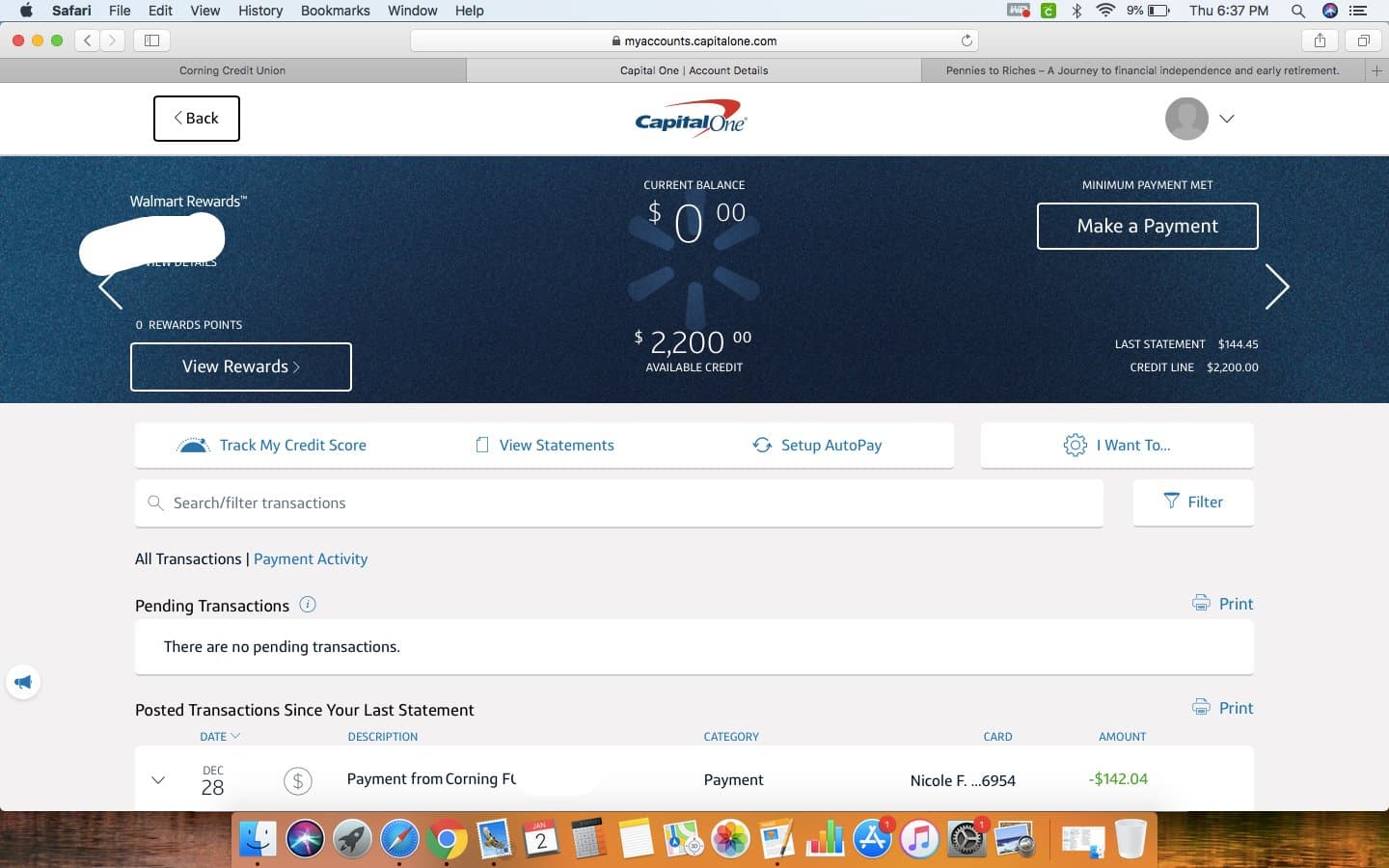

YAYYY!!! I paid off my Walmart credit card and the last payment hit the account. This is so awesome to see! It has been YEARS since this one has been fully paid off! I cannot wait to keep the snowball rolling in 2020! This is the year I will be debt free!

Weekly Update

Financial win of the week:

Christmas was a success! Everyone loved their gifts and it was all worth the $$. I am happy it’s over though, paying off debt is like swimming upstream during the holidays! For new years we stay in and eat snacks (pepperoni, crackers and cheese) with some mixed drinks from alcohol we have in the fridge (we drink so much it is still there from last year lol). The kids get sparkling grape juice- which is currently $2 and some change at aldi’s by the way! It will be awesome. This week I spent $95 on groceries which isn’t bad considering last week we never even grocery shopped! It was too crazy with the holidays so we survived off of what we had. That’s a win for me!

Continue reading “Weekly Update”FI Mindset

Pursuing FIRE has changed the way I think in almost every situation. I listen to commercials on the radio and the tv and think “how stupid, why would you buy this?” or “so basically you want people to think it’s okay to spend a ton on a credit card”. Listening to conversations amongst co-workers about what style is “in” (not that I ever cared about that anyway). Listening to an excited co-worker talk about her new car she ordered and how she “figured she might as well get her master’s since she is already up to her nose in debt anyway” in the same sentence! (EEEK!) It never stops!!!

Continue reading “FI Mindset”Weekly Summary

Hello again!

I am going to start briefly sharing a financial win and financial fail each week! Here is the first one!

Continue reading “Weekly Summary”Steps to FIRE

From what I’ve gathered thus far, there are many ways to achieve FIRE. There are a few things EVERYONE has to do to get there though! I thought I would try and tie together the steps to get to FIRE here in one post. I have noticed that the information is a bit scattered on other sources. So here is my take….

Disclaimer: it is best to start step #4 AFTER every debt (except your mortgage if you so wish) is paid off. The reason for this is, if you’re paying high interest on debt, investing doesn’t make much sense when you’re making lower or even returns with the interest you’re paying.

Continue reading “Steps to FIRE”Keeping Costs Low

I wanted to share how I keep my expenses SUPER low! I have always been one to look for every single way to save money! (I even went through the extreme couponing stage-literally like the ones you see on TV.)

Anyway, I wanted to compile a good list of ways to keep expenses low. I think most of these things are pretty repeatable! Some of them may take longer to repeat than others however!

Continue reading “Keeping Costs Low”More debt GONE!

Hey again! Here is my weekly debt payment, budget update!!

It was so exciting to see my first “full” check at my new job! I actually ended up missing one day when my 6 year old was sick and I had to get him at school. I made AFTER taxes $2300!!!!!! I couldn’t believe it! Oh and who knew that $.58 per mile would make such a huge difference! My rental also made me $100 this month and there was a late fee for our other rental giving us $10 more. I get child support every other Monday of $120 which, since my kiddos are well taken care of, I spend for my gas for 2 weeks! Oh AND the great state of new york (HA) sent me a “property tax relief” credit check totaling $440 which I of course had to share some of with my husband so I put the excess of that in my account too!

Continue reading “More debt GONE!”