Payday was Friday! These days I’m only excited for payday to pay off more debt!!!! Huge change from the past!

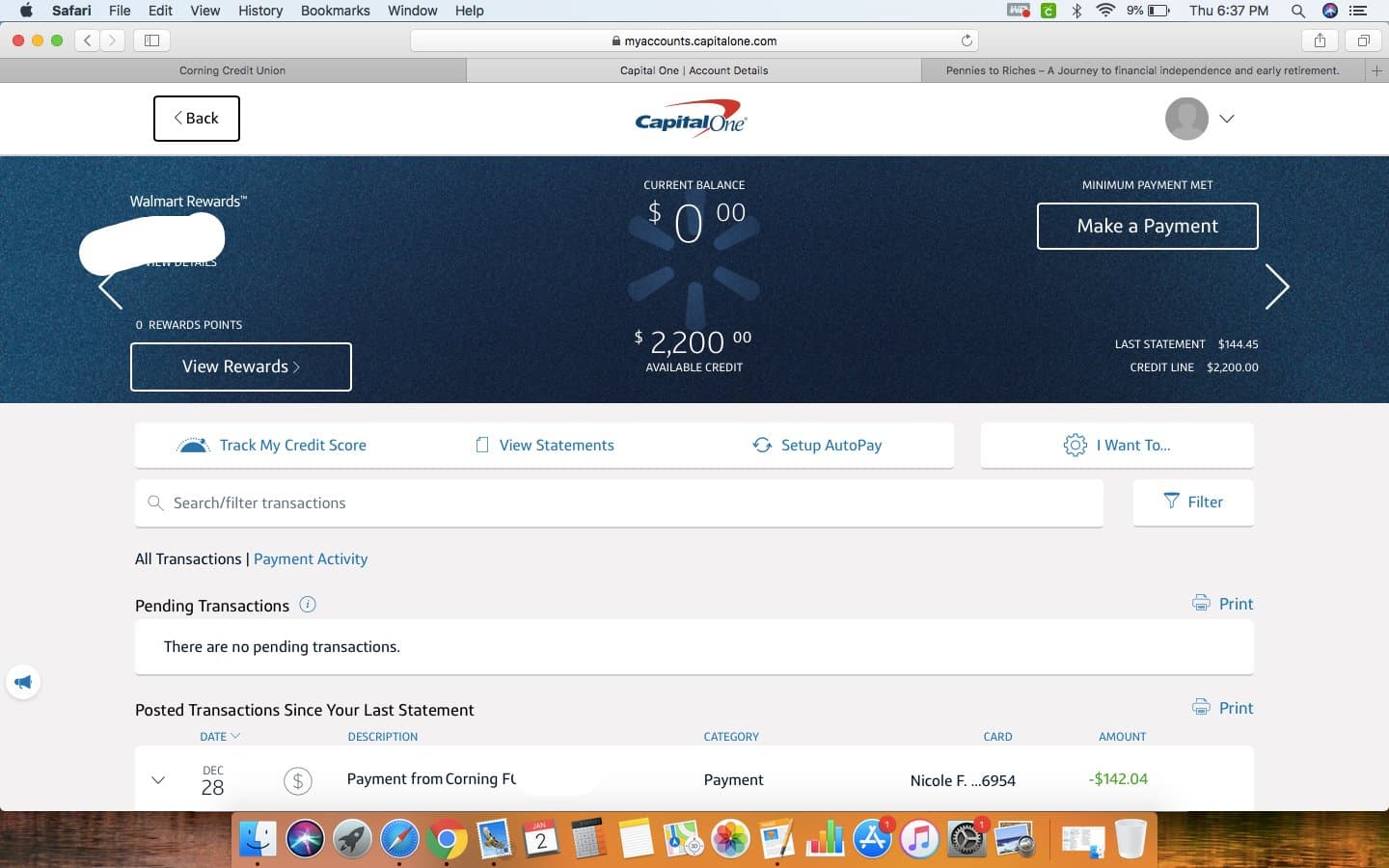

This week $1200 was sent to debt! $500 in minimum payments and $700 extra to my last credit card. That brings the grand total down to $978! Hopefully only one more payment and I will be credit card debt free!!!

Continue reading “Debt update!”